Get a Better Grasp of Studio Cash Flow With Walla’s Recurring Plan Payments Report

Understand your fitness business's current and future profitability, mitigate financial risks—and plan accordingly!

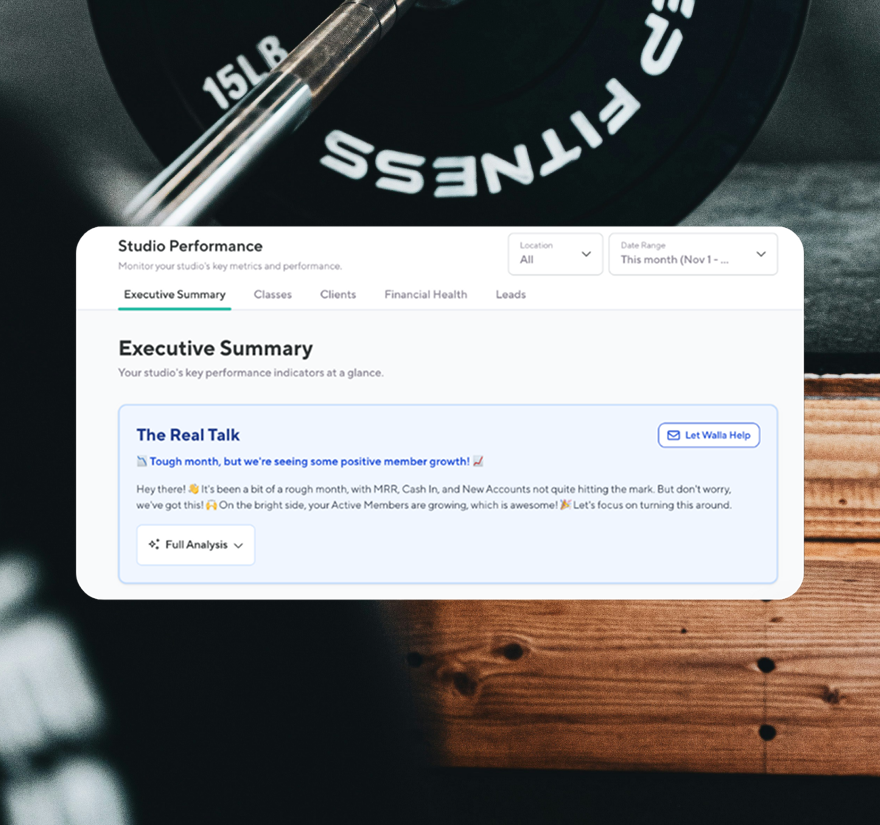

Fully understanding your studio's cash flow is critical to efficiently and effectively running your business. It also gives you insight into profitability and potential monetary issues. That’s the goal of Walla’s Recurring Plan Payment Report: to proactively provide your studio with the numbers you need to establish realistic metrics so you can make more informed decisions!

As one of the features you voted for in Walla’s Product Portal (your input matters!), the Recurring Plan Payments report enables you to understand your studio’s current and future cash flow related to unlimited and limited schedule-based recurring plans. Usage-based plans will not be reflected in this report as they don’t have a set payment date. Located in Walla under Reports > Financials > Recurring Plan Payments, this report allows you to filter by timeframe and see:

- Exact payment dates for clients

- Payment amounts (including tax)

- Plan and plan type

- Paused amount (if plan is paused)

- Plan end date

- Payment status

In the Recurring Plan Payments Report, Walla users can filter the date range by the current month, last month, and next month—or a custom date range up to 90 days. You can also view recurring plan data by location (active and inactive). Any upcoming payments will be shown, too.

“The recurring payments report will give you a more granular view of your autopays—both past and future. You can more effectively manage cash flow and predict revenue for certain periods of time with confidence.”—Laura Munkholm, President and Co-Founder of Walla.

Now that Walla’s Recurring Plan Payments Report can give you a reliable, accurate grasp on a piece of your studio profitability, here’s why having a deeper understanding of your current and future cash flow at your fitness business is critical:

Financial stability and survival

Cash flow is the lifeblood of any business in any industry, including fitness studios. It's not just about how much money is coming in and going out; it's about the timing of those inflows and outflows. Understanding your cash flow ensures that you have enough liquidity to cover your operational expenses, such as rent, utilities, payroll, and equipment maintenance, as well as any unexpected costs that may arise. With a solid grasp of your cash flow, you can avoid running into cash shortages that could jeopardize your survival and stifle the growth of your studio.

Effective resource allocation

Knowing your cash flow allows you to allocate resources effectively. By understanding when you'll have surplus cash and when you might experience cash crunches, you can plan ahead and allocate funds to areas of your fitness business that need them the most. For example, if you anticipate a slow season, you can set aside cash reserves to cover expenses during that period, or if you foresee an opportunity for expansion, you can allocate funds toward marketing or studio upgrades.

Accurate budgeting and forecasting

In the fitness and wellness industry, accuracy is vital! Cash flow projections enable you to create accurate budgets and forecasts for your fitness studio. You can develop realistic financial projections that guide your decision-making by analyzing historical cash flow data and considering factors such as seasonality, market trends, and business growth plans. This ensures that you're prepared for the present and equipped to navigate future opportunities and challenges confidently.

Debt management and financing

Understanding your cash flow is crucial for managing debt and financing arrangements. Lenders and investors often assess a business's cash flow to determine its ability to service debt and generate returns on investment. Maintaining a healthy cash flow and demonstrating your ability to meet financial obligations will enhance your credibility with lenders and increase your chances of securing favorable financing terms. Moreover, a strong cash flow position allows you to leverage debt strategically to fuel growth initiatives without overburdening your studio with excessive debt obligations.

Mitigating risks and seizing opportunities

Cash flow analysis helps you identify potential risks and opportunities facing your fitness studio. By monitoring cash flow trends and conducting scenario analysis, you can anticipate and mitigate risks such as revenue fluctuations, increased competition, or economic downturns. Additionally, you can capitalize on opportunities for growth, innovation, and market expansion by deploying resources efficiently and seizing strategic opportunities as they arise.

Enhanced strategic (and smarter) decision-making

Ultimately, understanding your cash flow empowers you to make informed and strategic decisions that drive the long-term success of your fitness studio. Whether investing in new equipment, expanding your services, entering new markets, or optimizing your pricing strategy, having a clear understanding of your cash flow provides the financial intelligence you need to make decisions that align with your business objectives and maximize value for stakeholders.

Mastering your current and future cash flow is essential for ensuring your fitness studio's financial health, stability, and growth. It's not just about managing money; it's about making intelligent, data-driven decisions that position your studio for long-term success in a dynamic and competitive market landscape.

Ready to upgrade your studio?

Let us show what Walla can do for you!

Latest articles

Stay in the loop

Get webinar announcements, industry news, product feature release announcements, Walla insights, and more delivered straight to your inbox!

%20-%202025-08-06T171547.606.png)

%20-%202025-08-07T222242.577.png)

%20-%202025-08-05T211155.122.png)

%20-%202025-08-05T164322.525.png)

%20-%202025-07-30T123218.666.png)

%20-%202025-02-07T095206.530.png)

%20-%202025-06-24T163406.559.png)

%20-%202025-06-23T164548.621.png)

%20-%202025-06-05T133636.454.png)

%20-%202025-04-29T110753.430.png)

%20-%202025-04-21T175210.819.png)

%20-%202025-04-21T143210.386.png)